A Look into Nigeria's Third-Party Logistics Industry (Part 1 of 2)

Industry Analysis

You have probably seen them zoom past you while in traffic, on their bikes with appended boxes wearing colourful helmets. It is hard to miss them in Lagos. In an estimated 30 minutes of traffic in Africa’s most populous city, you are likely to see a minimum of 10 to 30 of them go past you, depending on how busy the route is. Their driving might constitute a nuisance to pedestrians, traffic wardens and other road users, yet they are the delight of businesses [mostly e-commerce] and their customers.

But just how profitable is the Nigerian third-party logistics industry (3PL)? What does the future hold for the industry? How can new entrants achieve critical mass? What can an entrenched player do to consolidate his position? To answer some of these questions and provide insight into the industry, I will be analyzing the Nigerian third-party logistics industry.

First of all, just how important is logistics to the e-commerce value chain? In simple terms, the e-commerce value chain can be thought of as having three phases; the discovery phase, the purchase phase and the return phase (reverse logistics). The discovery phase, driven by technology, refers to marketing efforts on the part of a vendor that leads to a consumer learning of a product/service. In this phase, the customer anticipates a need, searches for a product or service to meet the need, and decides to acquire it. This process is complete when the customer discovers a product or service that meets their needs. And, as you tend to buy what is in front of you, the key to success in this phase is the internet placement and digital marketing. However, the discovery phase is unlike the next two phases, which are a bit more tangible and rely on human action and interference through logistics (refer to exhibit 1). The purchase phase and return phase rely on both technology and human actions to drive them. Although customer service, payment, refunds and other online features may not require a physical human interaction and therefore occur without much interference, logistics does and can be a possible chink in the armour of a business that is sometimes time-bound.

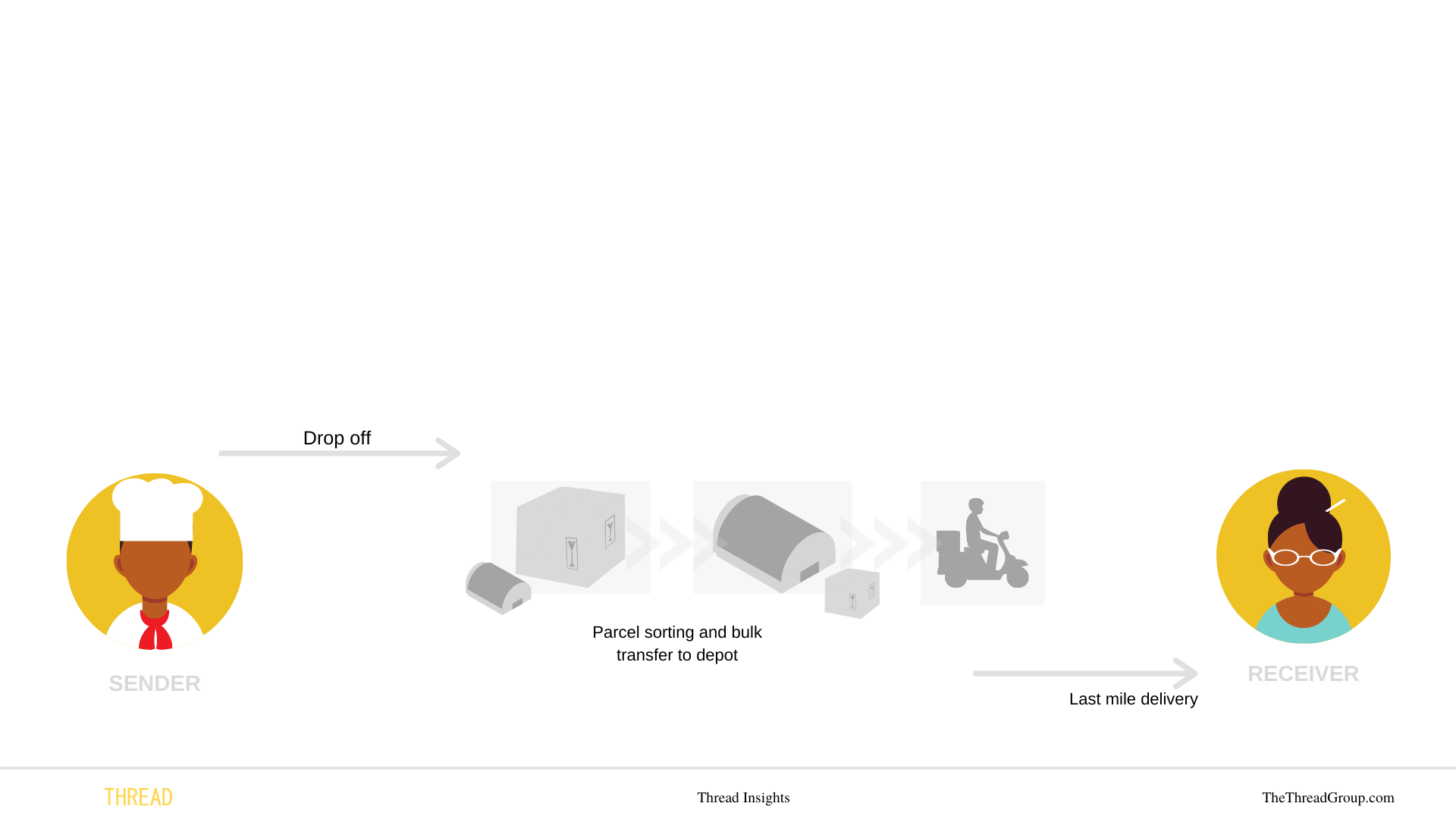

Exhibit 1

How attractive is this industry?

According to McKinsey and Co, the Nigerian e-commerce space is expected to be worth $10bn by 2025. As a rule of thumb, most customers are willing to pay 25% of a parcel’s worth as an express premium. So, you can expect (working with pre-covid-19 figures and taking recent market developments into account) the market size of the industry to be worth at least $2.5bn with a cagr of 7.5% over the next three years. Regarding market forces, the demand for 3PL services can be classified into time-bound and non-time-bound factors, and the services they render classified into the delivery of perishable and non-perishable goods. The time-bound logistics service industry is driven by a change in lifestyle behaviour in response to emerging discomforts such as traffic chokes, bad roads, and the growing distance between shops and many gated residential areas that have recently sprung up. The sort of goods that are purchased using this service is mostly perishable goods that have a utility deadline* On the other hand, the non-time-bound logistics service industry has been influenced by consumer interactions with a growing number of online grocery shops, lower perceived risk of the shopping process and safer and more efficient technology. Given the industry's dominant reliance on just road transportation, as well as projected rising internet penetration rates, these sectors are expected to keep growing.

In this research, we will focus on time-bound deliveries.

To start off, it is important to note that the customers who require time-bound deliveries are most times impatient and disloyal. This is understandable. Nobody wants to order lunch by 12 noon and receive it by 6 pm (refer to utility deadline*). In this market, the customer remains king. To understand their power, let us compare the business models operated by time-bound and non-time bound 3PL businesses (please refer to Exhibits 2 and 3). Exhibit 2 illustrates an older structure typically operated by traditional and entrenched players such as the post offices and long-term players like DHL, while Exhibit 3 illustrates a new model operated by emerging third-party logistics businesses in Nigeria.

*[Utility deadline is a time frame within which a product must be delivered to the customer or risk losing its appeal.]

Exhibit 2

Exhibit 3

Models operated within the industry

Referring to Exhibit 2, Traditional and entrenched players operate a hub and spoke model*. In this model, it is the sender's responsibility to drop off their parcels with the service provider. If they require additional services, like pick up, they are expected to pay for it. It is also worth noting that these traditional service providers do not typically receive time-bound perishable items. And what if a buyer requires express services or same-day delivery? ... (you guessed it) they have to pay a premium. Because these players do not typically receive time-bound items, they can afford the time required to sort and move their parcels to depots, which are usually in closer proximity to the buyer, before offering last-mile delivery. This setup also gives them an additional benefit of being able to make single cost-saving bulk deliveries to their depots, before the last mile delivery. Although having multiple depots could increase the cost structure of their services, they are classified under fixed costs which have been considered in the breakeven timeline.

This is in contrast to the model that emerging 3PL businesses are adopting. Many of them receive time-bound perishable goods, which eliminates the need for sorting and depots, before last-mile delivery (please refer to Exhibit 3). A model known as the point-to-point model. This, invariably, reduces the capital expenditure required to start the business. In addition, this adopted model allows them to be able to offer pick-up and same-day delivery. However, while these emerging 3PL businesses have managed to bring down their fixed costs, their operational costs have gone up; making profitability dependent on the volume of orders they receive. With a modest volume of orders, it is possible for these businesses to stay profitable in the short to mid-term. However, as the volume of the order increases, it is expected that the variable costs would eventually overwhelm the business.

It is now clearer to see how businesses that operate a time-bound (point-to-point) model render more premium services to their customers. This is ingrained by a competitive and homogenous service environment that is dependent on maximising volume.

*[Hub and Spoke model is a form of transport topology optimization in which traffic planners organize routes as a series of "spokes" that connect outlying points to a central "hub"]

*[The Point-to-Point model is a little different from the hub-and-spoke model. Instead of flying lots of flights into and out of one or two major airports, the point-to-point model emphasizes flying between two cities directly, regardless of size.]

Other market forces affecting profitability

Other factors influencing the Nigerian logistics industry include value chain inputs such as labour (bike riders, sorters etc), complimentary services (mechanics, spare parts etc.), financing (grants, loans etc.), macroeconomic factors (oil prices, inflation etc.) and government policies.

Unlike their traditional (and mostly larger) counterparts, emerging 3PL businesses have less bargaining power when negotiating with agents representing some of the aforementioned factors that make up the value chain. As regards labour, they struggle with a high turnover rate of drivers (who most times are working other jobs too). Regarding complementary services, they are unable to negotiate credit facilities with suppliers. The access to capital ‘playing field’ is more level than it used to be, as government grants and single-digit loans have assisted entrepreneurs in starting out. However emerging businesses are still a long way off in terms of financial muscle and, with rising operational costs, many emerging businesses may have to either merge or find new revenue sources. Macroeconomics factors affect all the players in the market and so do government policies; such as the ban on commercial motorcycles that led to the repurposing of many motorbike taxi businesses into logistics businesses. This was an easy switch in trade as there are little barriers to entry into the logistics industry except for the statutory fees set by the Courier Regulation Department of the Nigerian Postal Service (NIPOST) and moderate operating fees set by some state governments. In Nigeria, there are currently just over 500 officially registered 3PL operators - 77% of which are domiciled in Lagos.

Analysis at Thread Strategy shows that, in terms of new entrants, the years between 2000 to 2010 were one of tremendous growth in the industry. In contrast to this, the last decade ( 2010 to 2020) has seen the industry slump and consolidate. Technology, and the increasing number of e-commerce businesses today than they were twenty years ago, is expected to be the key drivers of entry into this industry.

Over the years, entry into this industry is likely to have been based on public perception of development within the markets. For example, the high returns of companies from 1999 to 2010 coincided with the inception of mobile phones into the Nigerian market. However, during the 2016-2017 recession, there was a slump in registration as fewer people perceived opportunities within a shrinking economy. In the current climate, it is plausible to hypothesize that the government policies regarding social distancing and lockdowns will be a key driver of entrants into this industry who perceive new industry opportunities. These opportunities are, however, available to both traditional and emerging 3PLs businesses. Recently, Red Star Express - a longstanding incumbent - announced its entry into the grocery space - an area that had previously been dominated by emerging 3PLs. However, for victory to be achieved in this industry, both emerging businesses and entrenched players will have to consider critical success factors.

Uche E Uche is an Analyst at Thread Strategy.

Part 2: Critical Success Factors

The second part of this research will contain quantitative data on factors that are driving success in the 3PL industry in Nigeria.