A Look into Nigeria's Third-Party Logistics Industry (Part 2 of 2) : Critical Success Factors

Recap

Conventional thinking within the third-party logistics (3PL) industry is that policy changes within the food and hospitality industry, favouring physical distancing and dining out, is expected to drive growth in the sector. However, sceptics are asking if food logistics - a typical time-bound 3PL - is really worth the while. Up until now, multinationals like DHL and UPS with capable manpower and a good geographical spread have not glanced towards this industry segment. Recently, however, Redstar - a publicly listed 3PL company - announced its entry into the timebound 3PL subsegment. As was the case with most companies listed on the Nigerian Stock Exchange, Redstar suffered revenue slumps in the second and third quarter of 2020. This could have influenced their decision to venture into a subsegment that has maintained strong indicators even through the lockdown.

How then can new entrants, and incumbents also, achieve profitability in this key subsegment. The first part of this report examined the market attractiveness of the 3PL industry in Nigeria and highlighted some of the forces that impact food logistics (our sample model of time-bound 3PLs). From our analysis, it was evident that, when compared to non-perishables, the delivery of perishable (and therefore time-bound) items has some potential pitfalls that could impact profitability. The first is that the utility deadline of these goods make them require the same day delivery. Same day delivery is susceptible to pressures such as bad road network, traffic jam and poorly mapped out geographic areas. The second is consumer surplus arising from fierce competition for customers. This competition for customers has forced new entrants to adopt a penetration pricing strategy - where the price of a product is initially set lower than cost price to rapidly reach a wide fraction of the market and initiate word of mouth. However, what has played out, in reality, is that customers get accustomed to low prices and are inelastic to a reinstating of market equilibrium prices when service providers decide it is time to instate them.

Meeting these customer expectations creates margin pressure for most new entrants. In addition, as a result of these companies being unable to accumulate orders before dispatch, it has become difficult for operators to achieve minimum efficient scale. To put this concisely; the point-to-point delivery model raises the long-run average total cost and exposes businesses diseconomies of scale.

In spite of these pitfalls, fragmentation within the industry offers hope that differentiation could bring new opportunities. The second part of our report will, therefore, identify the critical success factors in the industry. The objective is to clearly outline what the industry competes on and define problem statements that strategy development should be based on.

Industry Perspective

To identify the factors that the industry competes on, researchers at Thread Strategy focused on the business and pricing models of the entrenched players, as well as new entrants in the industry. We also interviewed businesses and customers who use these services. Based on the data gathered, we identified weight and distance as crucial elements when determining the price of a service.

Traditionally, these two metrics have defined the delivery of services. However, a closer examination of industry data reveals that the entrenched players pay more attention to the weight whilst new-model entrants focus on distance. The reasons for this are outlined.

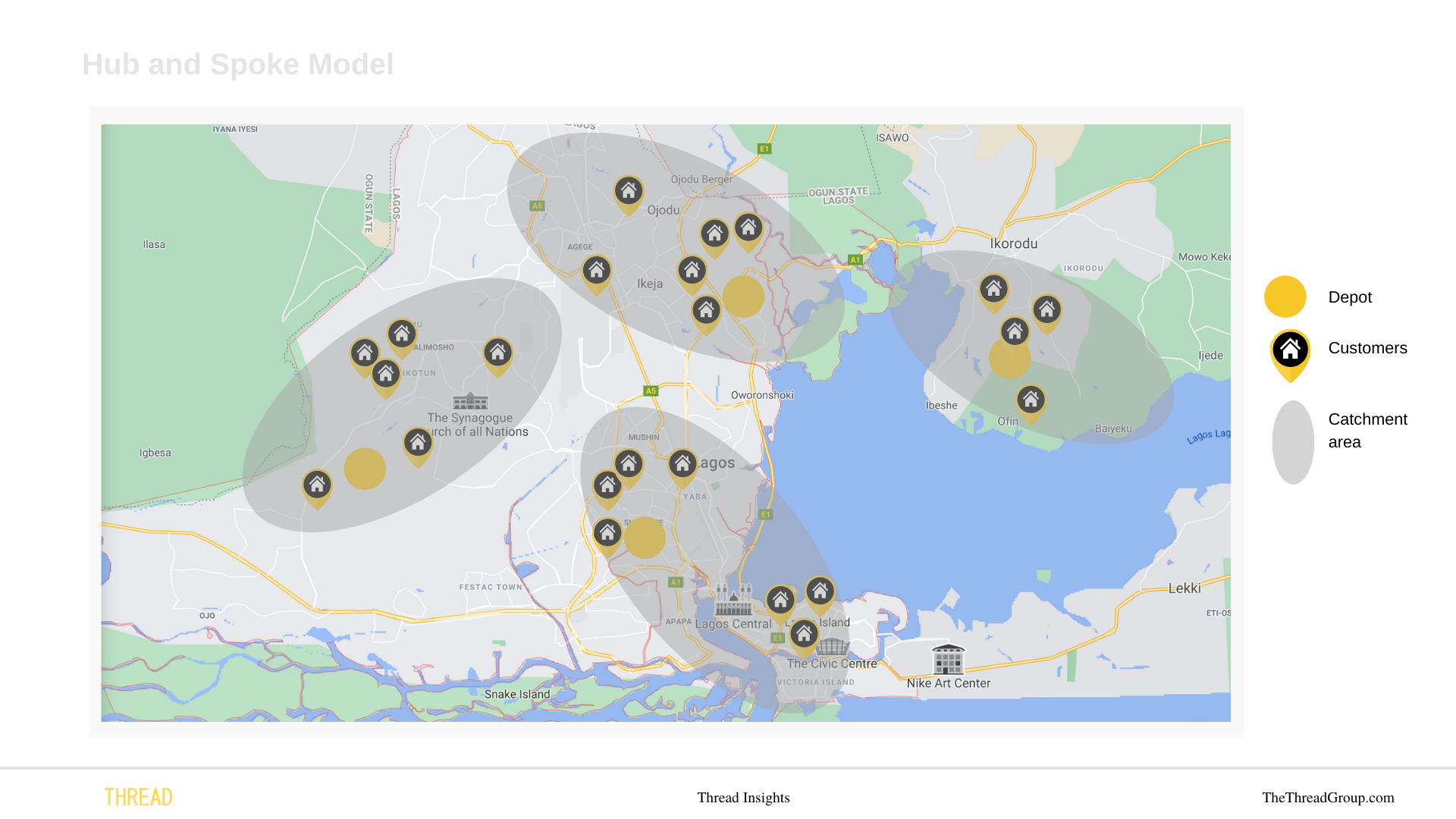

Exhibit II shows that many multinational large service providers who operate the hub and spoke model charge a fixed delivery fee within the central areas of the city and an additional premium for services outside these central areas. In contrast, local operators charge on mileage increment.

This is because, by having a lot of depots within the city, larger providers can minimize the distance - that make up a critical radius - from their depots to their customer (refer to Exhibit 2 for an explanation of critical radius). In contrast, the point-to-point model used by smaller new-comers maximizes the distance travelled.

In an industry where operational efficiency can be directly translated to cost savings, maximising distance can negatively impact the bottom line of a business. Most businesses attempt to overcome this by adopting the use of motorbikes, which use considerably less fuel, over vans. They argue that this mode of transporting deliveries reduce both capital and operating costs. Moreover, the main objective of adopting a point to point model in the first place was to overcome fixed cost barriers to entries that come with acquiring depot points.

However, research by Thread Strategy [outlined later in this report] has revealed that cost control should not be the sole reason for optimising travel distance. Optimizing distance can also enhance a business’ ability to take more orders. This, in turn, impacts revenue and ability to scale.

Volume Over Weight

The emphasis on weight by much larger service providers is also questionable - for the Nigerian market. In many parts of the world where airmail is the most commonly used method of parcel transportation, justification of weight as a criterion for pricing is easy. However, Nigeria is dominated by road transportation and this puts the current criteria for pricing into question.

Research studies by Thread Strategy have revealed that both intra-state and inter-state delivery services in Nigeria are dominated by motor and motorbike transportation (Exhibit III). And for this mode of transportation, the volume becomes a much more valid price-determining metric. This is because, unlike weight, volume influences the number of parcels than can be packed into a container. Large organisations looking to differentiate and scale could consider eliminating weight criteria for pricing and focus on volume.

Customer Perspective

Apart from the set-out criteria for pricing; weight and distance, several other factors currently impact the industry’s structure and profitability. To uncover these, Thread Strategy interviewed a wide-ranging pool of customers-clients (referring to non-business clients) and business-clients (referring to incorporated entities) that rely on outbound and inbound logistics.

There is much insight to be drawn from this research. However, we have highlighted some that are relevant to this report. If you would like to receive a more comprehensive report of our datasets and research, please email info@thethreadgroup.com.

For the most part, the bulk of orders handled by logistics service providers for both customer-clients and business-clients are non-perishable products (refer to Exhibit V). Possible validation of the industry’s consensus that the time-bound sector is an emerging high growth sector.

It was found that top priority for business-clients requiring logistics services was ensuring the integrity of their deliveries (item arriving intact). After which they were concerned with the arrival time and cost. Customer-clients were also concerned about the integrity of delivery and time elapsed. However, they were more concerned about a secure payment gateway than the cost of the service.

This all points to the importance of achieving operational excellence first. Once attained, service providers are able to achieve the integrity of delivery and in good time. How does this affect the bottom line? First of all, the integrity of purchase can shape the subsequent requests a 3PL company can get. If a company handled a request badly in the past, it is less likely that they would get further requests from the same business or a referral.

A standard rating agency was not found in the industry. However, we uncovered that customers use social media platforms like Twitter and Instagram. A bad reputation on these platforms has been shown to directly affect patronage. Research by The Thread Strategy sought to find out which factors businesses prioritized when selecting 3PL partners (refer to Exhibit VI). Our results showed that the track record was the third most important factor they used to select a partner. For this reason, operational excellence becomes a critical success factor in the industry.

Yet, the most crucial factor that business-clients consider when choosing a 3PL service provider to partner with is the basic availability (refer to Exhibit VI). Availability is a function of distance travelled, traffic conditions, the number of orders that a 3PL company is able to handle - based on the number of couriers they have. In the previous section, it was established that distance is a crucial metric in the logistics industry mainly due to its cost implication. However, longer travel distances could easily translate to delays in delivering orders and can also impact the availability of the dispatch rider to handle subsequent orders. And so can delivery to areas with heavy traffic. This way delays directly affect the revenue of 3PL companies. Simply put; No matter how cheap or efficient the services of a 3PL company is, if their couriers are engaged when a client needs delivery services, they are unable to offer that service. This reality is further buttressed by our review of customer loyalty. We found that 84% of business-clients go into partnership with more than one logistics service provider partners (refer to Exhibit VII).

After the consideration of all these factors, a few questions arise; what is the traffic reality in my city of operation and how predictable is it? what model should my 3PL business adopt? For the model I adopt, what is the profitability radius* and what does operational efficiency mean to me in terms of the number of couriers.

What Strategy Should I Adopt?

In the past, the industry competed on operational excellence, weight and distance. This report has highlighted that weight is not as important in the time-bound 3PL industry, so 3PL companies must look to eliminate it. In contrast, availability has been shown to be more crucial. Availability as a function of distance covered, good operations and a host of other factors. This can be optimised in several ways. The first is through increased investments - purchasing more couriers vehicles. However, this approach raises questions regarding returns on assets (ROA). Especially when scaling issues within the industry is taken into account.

Understanding the external factors that affect your business and positioning yourself to take advantage of them is also important. One good way 3PL companies can do this is to pre-empt their delivery. This means scheduling their deliveries. This method will allow businesses to deliver to their clients when traffic congestion is less dense. An option may be to deliver at night. However, security concerns and government restrictions may affect this.

Ultimately, the most important strategic question to ask boils down to ‘what is my critical profitability radius?’ And this is because the critical profitability radius is the one factor that connects all the factors together. Mapping it out and ensuring you do not exceed it is key to success.

To learn more about the strategic implication of the critical profitability radius and how to map it, get in touch with Uche@thethreadgroup.com.

Uche E Uche is an Associate at Thread Strategy.

For Full and Tailored Report: Contact Thread Strategy

The full report on the Logistics Industry contains a full presentation of research results, tailored and industry-wide action points and strategy.